“

Giving Opportunities

Founders’ Circle*

$10,000 and above

Charter Club*

$5,000 – $9,999

Leadership Circle*

$2,500 - $4,999

Blue and Gold Society*

$1,000 – $2,499

Cornerstone

$999 and below

* indicates Leadership Circle giving

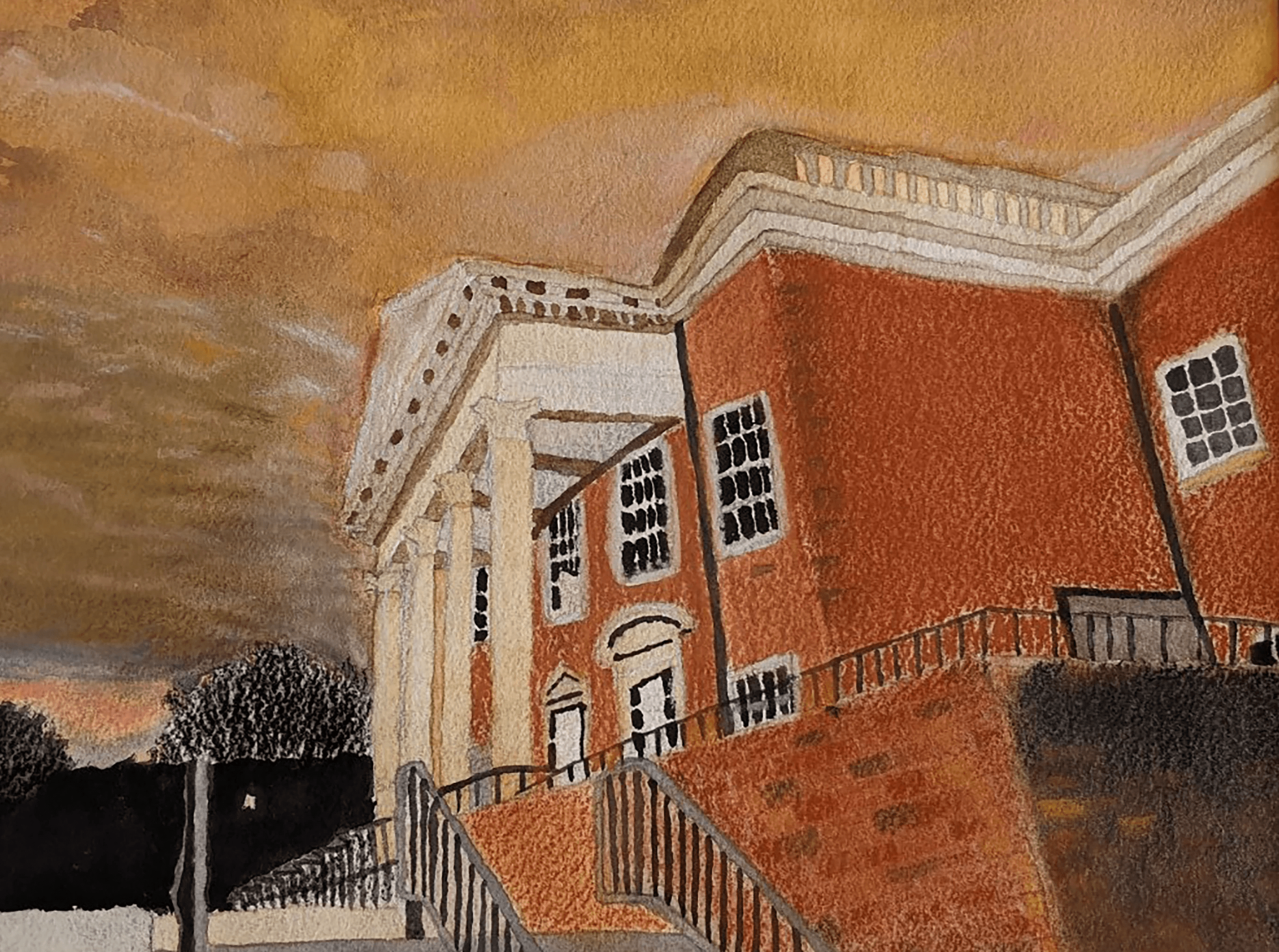

Library at Sunset

Watercolor by Jacob Lee ’24

Frequently Asked Questions

What does “unrestricted” mean?

CA Fund gifts are unrestricted. That means we have the flexibility to use the funds where they are most needed. Unrestricted gifts often have the most widespread impact on campus, supporting academics, clubs, athletics, facilities, professional development, the PTAA, and more.

Why doesn’t CA increase tuition instead of relying on an annual fund?

CA wants to remain both competitive and accessible. Raising tuition may outprice CA for many families, lessening our diverse community. Also, tuition is not tax-deductible, but donations to the CA Fund are. And that translates to a benefit for our families.

Is every family required to contribute to the CA Fund?

No. Annual participation in the CA Fund is voluntary (but check out our employee commitment!). That said, the more individuals, families, and businesses who participate, the more resources we have to support enhanced learning opportunities inside and outside CA classrooms.